Generalizations and the importance of understanding a business

Today, in several countries, investing in stocks is easier than at any other time in history. It is relatively straightforward for one to start investing or trading stocks, ETFs, Mutual Funds, and various other securities within minutes often after downloading a smartphone app and opening an account with one of several available providers. At the same time, there is an abundance of data, investment advice, and financial and economic information of a wide range of sophistication and quality.

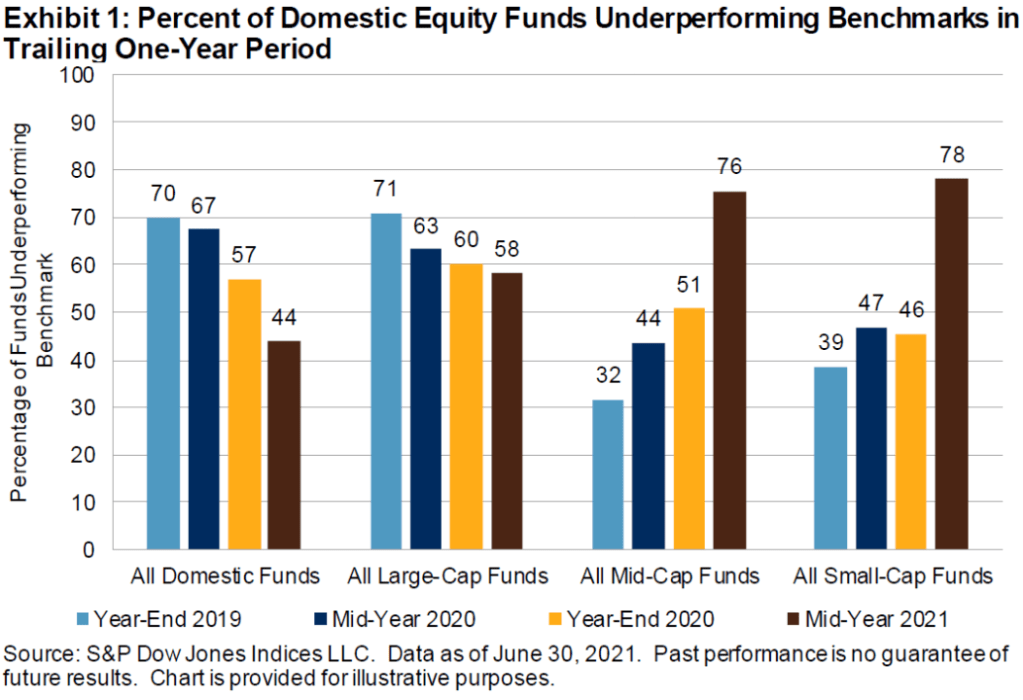

Despite this availability of resources, discussions about the Financial sector in media, the press, and investor forums are often simplistic which creates an opportunity for those willing to invest time to understand the unique characteristics of Financial sector companies.

Investors need to realize that the Financial sector is not uniform and that there is enough differentiation among Financial sector companies that knowledgeable investors can always find investment ideas despite the outlook for the economy, interest rates, regulation, politics, and so on as Financial sector companies are not uniformly exposed to the same risks.

For the inquisitive investor, reading this post it should be no surprise that a company like Aflac has a completely different business model and is exposed to different risks than JPMorgan Chase or that American Express is not comparable to Blackrock. What is more interesting in my view, is that Financial sector companies are not directionally sensitive to the same risk. Therefore, it is important for anyone investing in the Financial sector (as I am sure it is for investors in Technology) to understand how the companies they invest in generate profits.

To state the obvious in plain English, owning a common stock gives its owner a legal claim to its net worth or, a residual claim to its assets, in bankruptcy so one better knows how the company creates this net worth which not by chance is called Shareholders’ Equity by accountants. Parenthetically, it is worth remembering this fact when one tries to estimate the fair value of a stock.

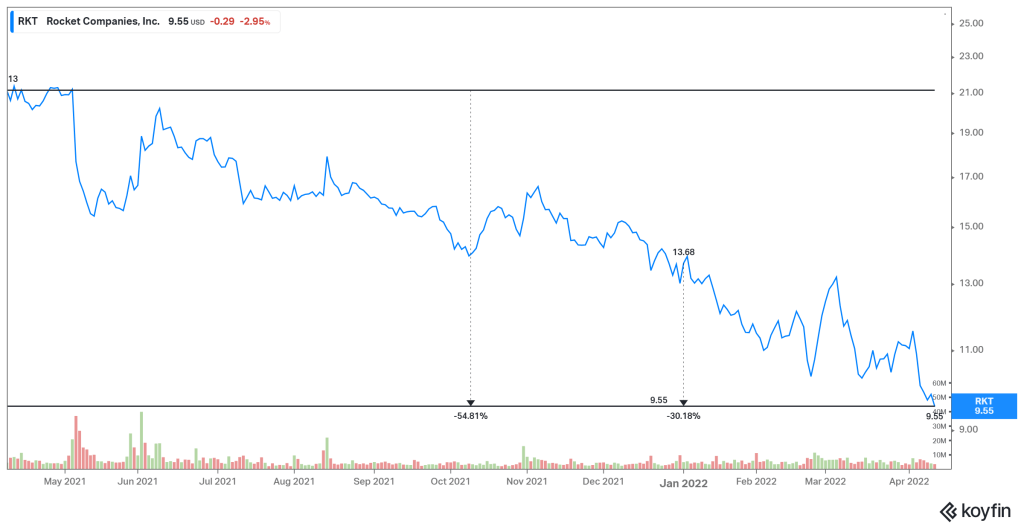

Investors who spend time understanding how a company makes money can “discover” opportunities to buy as well as to sell/short stocks. As a relevant example to my investment portfolio, the 54% decline of Rocket Mortgage (Symbol: RKT) over the last 12 months and 27% decline so far this year, is completely natural and was highly predictable to any investor who understood the mortgage originator’s business model and had a view that long-term rates were heading higher.